Get 7 free “Magnificent 7” fractional stock shares or up to a $300 transfer bonus when you download the free Moomoo App and open a Futu brokerage account with no commission fees, plus get additional bonus rewards when you refer your friends. [Read More] Moomoo – Free Trading App: Get 7 Free “Magnificent 7” Stocks ($5 Each Fractional Shares) OR Up to $300 Transfer Bonus (1.5% of Assets Transferred)

14 Best Investing Promotions and Brokerage Bonuses

Check out these investing promotions and brokerage bonuses that offer cash incentives, free stock rewards, investing credits, free portfolio management, commission-free trades, and more sign-up offers when you open new brokerage, retirement, investing, and trading accounts.

Best Free Stock Sign-Up Bonuses

Earn free stock awards with these trading services.

1. Webull 6-75 Free Stocks Bonus

Get 6-75 free stocks (valued $3-$3,000 each) when you open a Webull account and deposit funds, plus earn a 5% APY on your cash deposits.

2. SoFi Invest $25 Stock Bonus

Get $25 worth of your favorite stocks when you fund your SoFi Active Invest account with at least $10.

3. Firstrade 1 Free Stock Reward

Get 1 free stock valued between $3 and $200 when your new Firstrade account is approved.

4. Robinhood $30-$800 Free Stock Shares

Get a free stock worth up to $200 when you link your bank account, plus earn up to $600 worth of free stock shares when you make a qualifying deposit.

Best Investing Portfolio Promotion

For an easy way to create a personalized portfolio of stocks, bonds, and ETFs, check out this service to earn extra bonus cash in your investment portfolio.

5. M1 Finance $100 Account Bonus

Earn a $100 bonus when you fund your account with $10,000 or more for 30 days, plus you can easily build your own unique investment portfolio or track popular investors' portfolios.

Best Brokerage Account Bonuses

Earn bonus cash with these new brokerage accounts when you open a self-directed investment or retirement account.

6. Ally Invest $100-$3,000 Bonus

Earn $100-$3,000 in bonus cash when you deposit a minimum of $10,000 into a new self-directed trading account.

7. Merrill Edge $50-$750 Bonus

Earn $50-$750 in bonus cash when you open a self-directed IRA or CMA with a minimum deposit of $5,000.

Best Real Estate Investing Deals

Get a cash reward when you try these real estate investing services.

8. Fundrise $100 Bonus Investment

Earn a $100 bonus when you deposit a minimum of $10 into a diversified portfolio of real estate assets.

9. GROUNDFLOOR $50 Bonus Offer

Earn a $50 bonus when you invest at least $100 into high-yield, short-term real estate loans.

10. Worthy $10 Property Bonds Bonus

Get a $10 free bonus when you invest in short-term, secured real estate loans with Worthy.

11. Lofty Tokenized Real Estate $20 Free Credit

Get a $20 free credit to invest in tokenized real estate properties and receive daily rental income.

12. HappyNest $10 Commercial Real Estate Bonus

Get a $10 bonus when you invest a minimum of $10 in commercial real estate properties that provide regular income.

13. Landa 1 Free Share of Rental Real Estate

Get 1 free share of rental real estate properties when you join Landa for free and link a bank account.

Best Small Business Investing Offers

To easily invest in small businesses, check out this small biz investment platform to earn a special bonus.

14. Mainvest $20 Small Biz Investment Credit

Get a $20 free credit to invest toward your first small businesses just for creating a free Mainvest account.

Newest Investing Promotions

Review more investing promotions, brokerage deals, and free stock bonuses below.

Securitize – Private Market Investments: $100 Feeder Fund Credit (Accredited Investors)

Join Securitize to access private market investments with tokenized real-world assets for as low as $10,000, plus get a $100 bonus credit when you invest in your first Securitize Feeder Fund. [Read More] Securitize – Private Market Investments: $100 Feeder Fund Credit (Accredited Investors)

Hedonova – Invest in Alt Fund: $250 Bonus and $250 Referrals (Accredited Investors)

Join Hedonova to invest in an alternative mutual fund with a minimum of $10,000, plus get a $250 sign-up bonus, and earn a $250 bonus for every referral, available worldwide. [Read More] Hedonova – Invest in Alt Fund: $250 Bonus and $250 Referrals (Accredited Investors)

Rally – Alternative Asset Investing: $5 First Investment Bonus and $5 Referral Prizes

Rally gives everyone access to the luxury world of investing in exotic collectibles with no membership fees and no minimum deposit requirements to get started, plus you can get a $5 cash bonus after your first investment, and you can earn unlimited $5 rewards for referring your friends to Rally. [Read More] Rally – Alternative Asset Investing: $5 First Investment Bonus and $5 Referral Prizes

ETRADE Brokerage Account: Earn $100-$1,000 Bonus Cash with $1,000 Minimum Funding

ETRADE is offering up to $1,000 in bonus cash credits when you open an ETRADE brokerage account for a limited time. [Read More] ETRADE Brokerage Account: Earn $100-$1,000 Bonus Cash with $1,000 Minimum Funding

Vinovest – Fine Wine Investing: Get up to 4 Months Fee-Free via Referrals

Get up to 4 months of fee-free investing in fine wines and whiskey through Vinovest to diversify your portfolio, plus get up to 4 months of no fees for every Vinovest referral that you provide. [Read More] Vinovest – Fine Wine Investing: Get up to 4 Months Fee-Free via Referrals

GROUNDFLOOR Real Estate Lending Marketplace $50 Investor Bonus and $50 Referrals

GROUNDFLOOR is a real estate investing marketplace that is open to both non-accredited and accredited investors who can invest in short-term, high-yield returns that are backed by real estate.

Plus, for a limited time, you will earn a $50 bonus credit when you deposit and invest at least $100 into your new GROUNDFLOOR account. [Read More] GROUNDFLOOR Real Estate Lending Marketplace $50 Investor Bonus and $50 Referrals

Webull Trading App: Get $18/$60/$225 Free Stocks Bonus with $1/$500/$25,000 Deposit

Check out Webull to trade your favorite stocks with $0 commissions, plus get 6/20/75 free stocks (valued $3-$3,000 each) when you deposit $1/$500/$25,000 into your new Webull account, earn a 5% APY on cash deposits, and receive additional referral bonuses for sharing Webull with your friends. [Read More] Webull Trading App: Get $18/$60/$225 Free Stocks Bonus with $1/$500/$25,000 Deposit

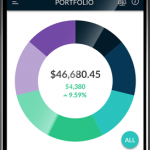

M1 Finance – Free Investing Platform: $100 Sign-Up Bonus + $100 Referrals + Up to $20,000 Account Transfer Promotion

Make investing your money simple using M1 Finance with no commissions ever and no fees, plus get a $100 bonus credit when you fund a minimum of $10,000 into your new brokerage or retirement account.

On top of that, you can earn up to $20,000 in bonus cash when you transfer a brokerage account to M1 Finance for a limited time. [Read More] M1 Finance – Free Investing Platform: $100 Sign-Up Bonus + $100 Referrals + Up to $20,000 Account Transfer Promotion

Alto – CryptoIRA or Alternative Asset IRA: $50 Bonus + $50 Referrals

Get a $50 cash bonus when you open an Alto CryptoIRA with no monthly account fees and fund a minimum of $10 within 45 days, or get $50 in fee credits when you open an Alto Alternative Asset IRA to invest in startups, private equity, real estate, and other real assets, plus earn additional $50 rewards for referring your friends. [Read More] Alto – CryptoIRA or Alternative Asset IRA: $50 Bonus + $50 Referrals