Get a $450 cash bonus from First Horizon Bank when you open a new consumer checking account, available for both new and existing clients who meet the qualifications. [Read More] First Horizon Bank: Earn $450 Cash Bonus with FirstView or SmartView Checking Account (AL, AK, FL, GA, LA, MS, NY, NC, SC, TN, TX, VA)

42 Best Banking Bonuses and Credit Union Promotions

Earn extra money by participating in banking bonuses and credit union promotions from national, regional and local banks and credit unions that offer cash rewards for opening new checking, savings, and business accounts.

Best Banking Bonuses - Nationwide

If you're looking for an everyday bank account for spending and saving, these banking promotions are available for all U.S. residents and can be fully accessed online, so you can manage your money from anywhere at any time.

1. MoneyLion $60 New Account Bonus

Get a $10 bonus just for opening a new RoarMoney account from MoneyLion, plus earn an extra $50 bonus when you receive a minimum $100 direct deposit within 60 days.

2. Chime Account $460 Bonus

Earn up to a $460 bonus when you receive a $200 direct deposit within 30 days of joining, plus get a free Spending Account with a debit card and a free Saving Account.

3. SoFi Checking and Savings $25-$325 Bonus

Earn a $25 bonus when you open and fund your new SoFi Checking and Savings accounts with just $50, plus get up to an extra $300 bonus when you receive total direct deposits of $1,000 or more, and pay no account fees or ATM fees worldwide.

4. Upgrade $200-$400 Rewards Checking Bonus

Get a $200-$400 bonus when you open a new checking account and either complete 3 debit card purchases within 60 days or direct deposit at least $1,000 within 45 days, plus earn up to $200 with a Premier Savings Account.

5. Monzo Mobile Banking $20 Bonus

Earn a $20 bonus when you open a Monzo mobile banking account and spend $10 on your new debit card.

6. Varo $30 Checking Account Bonus

Get a $30 bonus when you deposit $25 or more into your new checking account and spend at least $25 on your debit card within 30 days.

7. OnePay Cash $156 Mobile Banking Bonus

Get a $156 bonus when you receive a direct deposit of $500 or more with your new OnePay Cash mobile banking account.

8. Axos $50 Checking Bonus

Get a $50 cash bonus when you open a new checking account and complete $1,500 in direct deposit funding within 90 days of opening the new account.

9. Ally Bank $100 Spending Account Bonus

Get a $100 bonus when you open an Ally Bank Spending Account and receive a qualifying direct deposit.

10. Discover Cashback Debit Checking $60 Bonus

Get a $60 bonus when you open a Discover Cashback Debit Checking Account and deposit $50 or more.

Best Credit Union Deals - Nationwide

Anyone in the U.S.A. can start a new membership to get these credit union bonuses, so you can open an account regardless of where you live, plus you'll get access to all of the services that each credit union has to offer.

11. Langley FCU $50 Checking Bonus

Earn a $50 bonus when you open a new checking account and either complete 10 debit card transactions or deposit at least $1,000 into your savings accounts.

12. Financial Partners $100 Checking Bonus

Earn a $100 bonus when you open a new savings account with a $25 deposit and a new checking account with a $500 monthly direct deposit and $300 in debit card purchases within 60 days.

13. Fairwinds CU $175 Checking Bonus

Earn a $175 bonus when you open a new checking account and receive a total of $1,000 in direct deposits within 60 days.

14. Jovia FCU $150 Checking Promotion

Get a $150 bonus when you open a checking account and receive a direct deposit of $100 or more (direct deposit may not be required, as an ACH transfer works as well).

15. PSECU $300 Checking Bonus

Earn a $300 bonus when you open a savings and checking account, log in to digital banking, and receive at least 2 direct deposits of $500 or more each within 100 days of establishing membership.

16. BECU $100 Checking Bonus

Earn a $100 bonus when you open a Member Share Savings and Checking Account and make 10 transactions, which includes debit card purchases, ATM deposits or withdrawals, and online bill payments, so it's relatively easily to qualify for the $100 bonus.

17. First Tech FCU $300 Bonus Promotion

Get a $300 bonus when you set up a qualifying direct deposit for at least $1,000 monthly for 3 consecutive months.

18. Affinity FCU $100 Debit Account Bonus

Earn a $100 bonus when you open an Affinity Cash Back Debit Account and establish recurring direct deposits totaling $500 or more per month within 60 days.

19. Unify FCU $150 Checking Bonus

Get a $50 bonus just for opening a Unify Checking Account with a debit card, get another $50 bonus with a direct deposit of $500 per month, and earn up to another $50 bonus with qualifying debit card purchases.

20. GTE Financial $45 Checking Bonus

Get a $45 bonus just for opening a GTE Financial savings and checking account and enrolling in eStatements.

21. BluPeak $75 Checking Bonus

Get a $75 bonus when you open a new checking and savings account and receive at least 2 direct deposits totaling $500 or more within 90 days.

22. Securityplus FCU $50 Checking Bonus

Get a $50 bonus when you open a new checking account with a $50 minimum opening deposit, and you only need to maintain your checking account in good standing for 30 days to meet the qualifications for the $50 reward.

23. OnPath FCU $100 Checking Bonus

Get a $100 bonus when you open a personal or business checking account, make 15 debit card transactions, and receive $250 in direct deposits within 60 days of account opening.

Best Savings Promos - Nationwide

If you want to earn a high interest rate on your savings, check out these special savings account promotions to earn an extra bonus when you open your new savings account.

24. Laurel Road $200 High Yield Saving Bonus

Earn up to a $200 bonus when you deposit at least $5,000, plus earn a 5% APY on your deposits.

25. Discover $150/$200 Online Saving Bonus

Earn a $150/$200 bonus when you deposit $15,000/$25,000 in funding for 30 days, plus earn a 4.30% APY on all balances with no minimum balance and no maintenance fees.

26. Alliant Credit Union $100 Savings Bonus

Get a $100 bonus when you open a savings account and deposit at least $100 per month for 12 consecutive months, plus earn a 3.10% APY on your savings balances with open membership available to anyone.

27. Raisin Savings Network $25-$125 Deposit Bonus

Find the highest nationwide savings account rates with Raisin and earn up to $125 in bonus cash when you make qualifying deposits.

Best Banking Offers - Regional

Depending on where you live, you may be eligible to earn these banking offers, as they are restricted by state residency. However, these are all major banks that offer a wide variety of products along with tons of banking services and account features.

28. Chase Bank $900 Checking Bonus

Earn up to a $900 bonus when you open a Chase Total Checking Account with a direct deposit, plus get access to various other Chase Bank promotions for college checking and business checking accounts.

29. TD Bank $500 Promotion

Earn a $150 or $300 bonus when you open a TD personal checking account with a direct deposit, plus get an extra $200 when you also open a TD savings account with a qualifying deposit at the same time.

30. Truist Bank $400 Checking Bonus

Get a $400 bonus when you open a new checking account, receive 1 direct deposit of $500 or more, and complete 15 debit card purchases.

31. Fifth Third Bank $325 Checking Bonus

Earn a $325 bonus when you make direct deposits totaling $500 or more into your new checking account within 90 days of account opening.

32. U.S. Bank $500 Checking Bonus

Get up to a $500 bonus when you open a new personal checking account with 2 or more direct deposits totaling at least $3,000, plus get an extra $300 bonus when you open a new savings account with $25,000 in deposits.

33. Wells Fargo $400/$3,500 Checking Promotion

Get a $400 bonus when you open a personal checking account and receive $3,000 or more in direct deposits within 90 days, or bring $500,000 in new deposits for a $3,500 bonus with a Premier Checking relationship.

34. M&T Bank $200 Checking Promotion

Earn a $200 bonus when you receive a total of $500 in direct deposits into your new checking account within 90 days.

35. Bank of America $300 Checking Bonus

Get a $300 bonus when you open a personal checking account and receive direct deposits totaling $2,000 or more within 90 days, or get $200 in bonus cash with a business checking account.

36. PNC Bank $50-$400 Checking Bonus

Get up to $400 in bonus cash when you open a personal checking account with a qualifying direct deposit.

37. Citibank $500-$2,500 Checking Bonus

Get up to $2,500 in bonus cash when you open a Citibank checking account and deposit a minimum of $30,000.

Best Business Banking Bonuses

If you are looking for a banking service for your small or medium-sized business, review these banking promotions that are available for all types of businesses and even freelancers.

38. Mercury Business Banking $250 Cash Bonus

Get a $250 cash bonus when you open a new Mercury business banking account and deposit $10,000 or more within the first 90 days.

39. Brex $800 Cash Management Account Bonus

Earn up to $800 in bonus cash when you open a Brex corporate card and cash management account, which gives you access to instant financing for your business along with all of the tools you need to manage your everyday financial transactions.

40. Novo $40 Promotion

Earn a $40 bonus when you deposit $100 or more into your new Novo account, and get a free business checking account that is designed for sole proprietors and all U.S.-based businesses.

Best Student Banking Promotion

If you are a teenager or young adult, take advantage of this banking solution to help both kids and parents manage your finances better.

41. Step $1 Account Bonus

Earn a $1 bonus just for opening a new Step account, which offers a mobile banking app with a free debit card and no banking fees.

Best Health Savings Account Bonus

If you are looking to maximize your tax savings with a health savings account, check out this offer to get a special bonus with a new HSA.

42. Lively HSA $35 Bonus Offer

Get a $25 bonus when you open a new Health Savings Account and contributed at least $1,000 within 90 days, plus get an extra $10 bonus if you maintain an average daily balance of at least $2,000 for the first 12 months.

Newest Banking Offers

Review more banking bonuses and credit union promotions below.

CIT Bank eChecking Account up to $100 Cash Bonus (Nationwide)

If you open a new CIT Bank eChecking account or enroll your existing eChecking account, you can earn up to a $100 cash bonus when you make a qualifying deposit or transfer into your account, available nationwide. [Read More] CIT Bank eChecking Account up to $100 Cash Bonus (Nationwide)

USAA Classic Checking Account $250 Bonus (Free Open Membership for Military)

With free nationwide membership available to current or former military members, military spouses, and children of USAA members, you can get a $250 cash bonus when you open a USAA Classic Checking account and receive a direct deposit of $100 or more. [Read More] USAA Classic Checking Account $250 Bonus (Free Open Membership for Military)

Point Breeze Credit Union: “Give $90, Get $90” Referral Bonuses (Maryland)

With membership available to eligible residents of Maryland, both current and new Point Breeze Credit Union members can earn a $90 bonus each when the new member opens a share savings account and checking account. [Read More] Point Breeze Credit Union: “Give $90, Get $90” Referral Bonuses (Maryland)

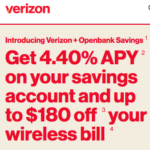

Openbank Savings Account up to $180 Verizon Bill Credit & 4.40% APY for Verizon Wireless Customers

If you are a Verizon wireless customer, you can get up to $180 in bill credits when you open an Openbank Savings Account, plus earn a 4.40% APY with no monthly fees. [Read More] Openbank Savings Account up to $180 Verizon Bill Credit & 4.40% APY for Verizon Wireless Customers

Sunward Federal Credit Union: $225 New Member Bonus & $75 Referral Rewards (Open Nationwide Membership)

Anyone in the U.S.A. can join Sunward FCU to earn a $225 bonus with a new savings and checking account, plus current members can earn unlimited $75 rewards for sharing Sunward FCU with your friends and family. [Read More] Sunward Federal Credit Union: $225 New Member Bonus & $75 Referral Rewards (Open Nationwide Membership)

DCU – Digital Federal Credit Union: $50 Bonus and $25 Referrals (Nationwide)

Regardless of where you live in the U.S.A., you can join DCU to earn a $50 sign-up bonus and 5.50% APY on balances up to $1,000, plus you can share DCU with your friends to earn unlimited $25 referral rewards. [Read More] DCU – Digital Federal Credit Union: $50 Bonus and $25 Referrals (Nationwide)

Hancock Whitney Bank: $200 Freestyle Checking Account Bonus (AL, FL, LA, MS, TX)

If you live in the Gulf South region, take advantage of this offer from Hancock Whitney Bank to get a $200 cash bonus when you open a new Freestyle Checking Account. [Read More] Hancock Whitney Bank: $200 Freestyle Checking Account Bonus (AL, FL, LA, MS, TX)

Baxter Credit Union (BCU): $25 New Member Bonus with $25 Deposit & $25 Referral Rewards + Up to 8% APY PowerPlus Checking Intro Offer (Open Membership Nationwide in U.S.A. and Puerto Rico)

With free open membership available throughout the United States and Puerto Rico, join BCU today to get a $25 new member bonus when you deposit $25, plus earn an extra $25 bonus for each new member that you refer, and take advantage of the PowerPlus Checking promotion for a limited time to earn up to an 8% APY for your first 3 months and beyond when you refer your friends. [Read More] Baxter Credit Union (BCU): $25 New Member Bonus with $25 Deposit & $25 Referral Rewards + Up to 8% APY PowerPlus Checking Intro Offer (Open Membership Nationwide in U.S.A. and Puerto Rico)

Wells Fargo: $400 Everyday Checking Promotion + $125 Clear Access Banking Bonus + $3,500 Premier Checking Offer

If you live in an eligible location, you can earn a $400 Wells Fargo Everyday Checking bonus when you receive a total of $3,000 or more in direct deposits within 90 days, or take advantage of other Wells Fargo checking account promotions to earn $125 to $3,500 in bonus cash. [Read More] Wells Fargo: $400 Everyday Checking Promotion + $125 Clear Access Banking Bonus + $3,500 Premier Checking Offer